Wang Corporation's Capital Structure Consists Of 40 000 Ordinary Shares

Its target capital structure is 40 debt and 60 equity. CORPORATE FINANCE FINAL EXAM.

Problem 1 Daniel Corporations capital structure consists of 40000 ordinary shares.

Wang corporation's capital structure consists of 40 000 ordinary shares. On July 15 2009 it issued 10000 shares at P23 per share. At December 31 2015 an analysis of the accounts and discussions with company officials revealed the following information. Paid to the majority shareholder the sum of P80000 for a certain parcel of land.

5000 Particulars Plan A Plan BEarnings. A study of publicly held companies in this line of business suggests that the required return on equity is about 17 percent. At December 31 2011 an analysis of the accounts and discussions with company officials revealed the following information.

Sales 1100000 Purchase discounts 18000 Purchases 642000 Loss on discontinued operations net of tax 42000. 1000000shares of Rs100 per value and FRS. Given that its net income is expected to be 600000.

At 31 Dec 2011 a companys capital structure was as follows. Has 40 million shares outstanding selling at 20 per share and a debt-equity ratio in market value terms of 025. Is low geared as its capital structure comprises of 60 of equity capital and only 40 of the fixed cost bearing securities.

The share capital of Tufa Co consists of 12m of ordinary shares and 5m of irredeemable preference shares. Solution When EBIT is Rs. Wang Corporations capital structure consists of 40000 ordinary shares.

2 2 Date Cash 20000 x 20 x 25 Subscriptions receivable 20K x 20 x 75 Subscribed share capital 20000 x 1 Share premium. At December 31 2019 an analysis of the accounts and discussions with company officials revealed the following information. Newell Corporations long term capital structure consists of the following at the end of the current fiscal year on November 30 2006 P10000000 of 8 convertible bonds 100000 shares of P5 par value ordinary share 40000 shares of P100 par value 6 cumulative preference share.

Case 1 Income statement Wang Corporations capital structure consists of 40000 ordinary shares. Issuing share capital at par. The dividend for 20X7 will be paid in the near future.

500000 25p ordinary shares 125000. The taxrate is 50. Accounting questions and answers.

Earnings before interest and taxes EBIT are projected to be 14000 if economic conditions are normal. Narsan Holdings is authorized to issue P1000000 ordinary shares divided into 10000 shares with a par value of P100 per share. It has the following capital structure in market value terms.

But B Ltd. Date Cash 10000 x 14 Share capital 10000 x 1 Share premium. FINANCIAL DISTRESS AND CAPITAL STRUCTURE BANKRUPTCY AND AGENCY COSTS When a firm uses more and more of debt in its capital mix the financial risk of the firm increases.

Wang Corporations capital structure consists of 40000 ordinary shares. 4000000 6 preference shares 1000000 8 Debentures 3000000 8000000 The market price of the companys equity share is Rs. The CAPM approach was used.

The board of directors of Yancey. Share Issuance for Cash Most share issues are for cash since the primary reason for issuing shares is to raise capital for a corporations operating activities. It may not be able to pay the fixed.

You have been asked to analyze the capital structure of DASA Inc and make recommendations on a future course of action. And issued 5000 ordinary shares for the building on the land. It is expected that company will pay a dividend of Rs.

Particulars Plan A Plan BDebenture interest at 10 40000 10000Equity share Rs. The required return on each component source of capital is as follows. 1000000 of 10 debentures.

Assuming a 40 percent marginal tax rate what after-tax rate of return must. Sales 1050000 Purchase discounts 18000 Purchases 642000 Loss on discontinued operations net of tax 28000 Selling expenses 128000. Sales increased by 20 from 100000 units to 120000 units the selling price is FRS.

The beta of the. EBIT and Leverage Money Inc has no debt outstanding and a total market value of 150000. Equity share capital 200000 shares Rs.

Variable cost amounts to Rs6 per unit and fixed expenses amount to FRS. Share premium account 100000. The ordinary shares of Tufa Co have a nominal value of 050 per share an ex dividend market price of 707 per share and a cum dividend market price of 752 per share.

If there is a strong expansion in the economy then EBIT will be 30 higher. Problem 7 A Limited has the following capital structure. The income tax rate is.

100 300 20 380. At December 31 2011 an At December 31 2011 an analysis of the accounts and discussions with company officials revealed the following information. The land was appraised at P130000.

Sales Purchase discounts Purchases Selling expenses Cash Accounts receivable Share capital Accumulated depreciation Dividend revenue Inventory January 1 2019. Which one of the following events would not require a journal entry on a corporations books. At December 31 2019 an analysis of the accounts and discussions with company officials revealed the following information.

Plans to maintain its optimal capital structure of 40 percent debt 10 percent preferred stock and 50 percent common equity indefinitely. View Test Prep - 201807031222211260015134_Quiz 4docx from ACCT 6034 at Universitas Pelita Harapan. Has 1 million 10 ordinary shares in issue and the market capitalisation value of the company is 500 million.

1 per share cash dividend. After-tax profits for next year are expected to be 200 million. Wang Corporations capital structure consists of 50000 ordinary shares.

Wang Corporations capital structure consists of 50000 ordinary shares. The capital structure of the Progressive Corporation consists of an ordinary share capital of FRS. How much should this firm payout to its shareholders if it sticks to the residual distribution model.

Its authorized share capital consists of 100000 ordinary shares with par value P20 per share. 10 each 10000 40000Total investment needed 50000 50000Number of equity shares 4000 1000 The earnings before interest and tax are assumed at Rs. On October 15 2009 the Beauty Corp.

Debentures 6000000 Preferred stock 2000000 Common stock 320000 shares 8000000 16000000 The company has a marginal tax rate of 40 percent. 140 10 130 Date Share premium Cash. Chapter 11 Question Review 2 8.

Problems Relating to Capital Structure and Leverage 1. 2 per share at the end of current year which will grow at 7 per cent for. If there is a recession then EBIT will be 60 lower.

The term legal capital is a descriptive term for a.

Understanding And Managing Suspended Solids In Intensive Salmonid Aquaculture A Review Schumann 2020 Reviews In Aquaculture Wiley Online Library

The Role Of China In The Middle East And North Africa Mena Beyond Economic Interests Iemed

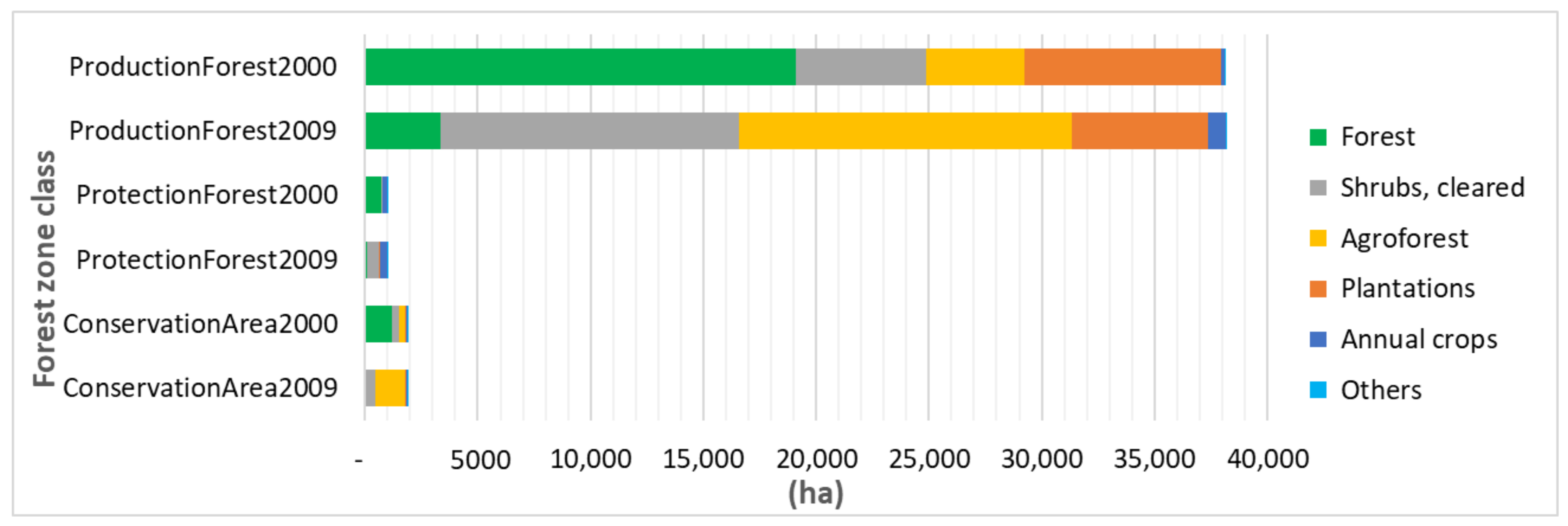

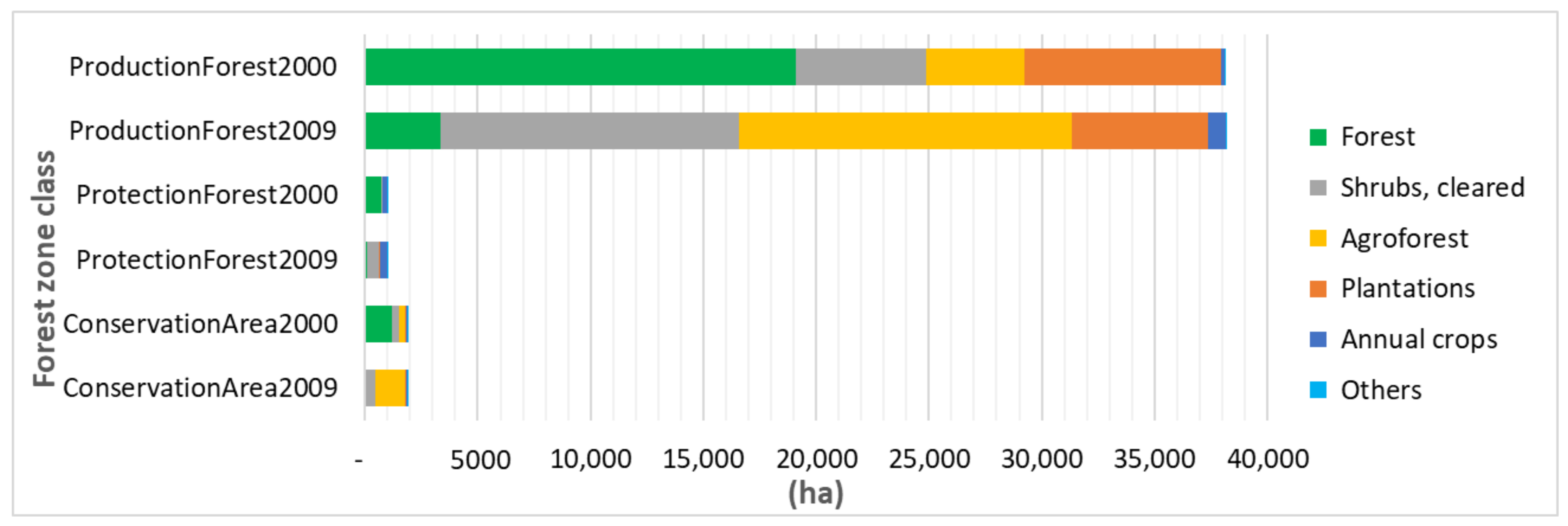

Land Free Full Text Agroforestry As Policy Option For Forest Zone Oil Palm Production In Indonesia Html

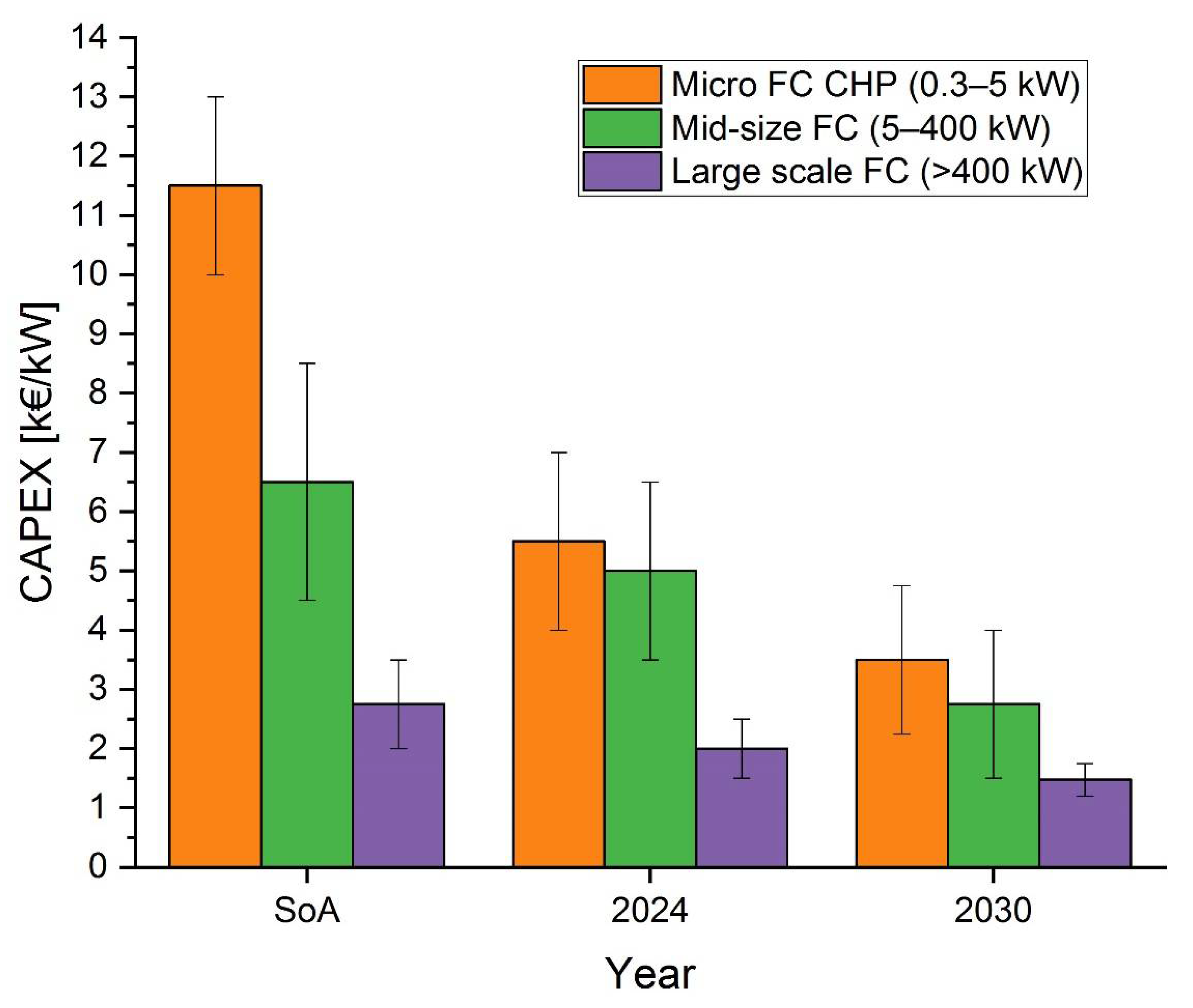

Energies Free Full Text Comprehensive Review On Fuel Cell Technology For Stationary Applications As Sustainable And Efficient Poly Generation Energy Systems Html

Renewable Energy Cooperatives As An Instrument Towards The Energy Transition In Spain Sciencedirect

Posting Komentar untuk "Wang Corporation's Capital Structure Consists Of 40 000 Ordinary Shares"